Exness Deposit and Withdrawal

Exness Deposit and Withdrawal services lead in online trading transactions, providing fast, secure fund management for traders and businesses. With advanced technology, these services offer smooth transactions, allowing users to concentrate on trading strategies and growth.

Within the Exness Group, renowned for its excellence in the financial services sector, our Deposit and Withdrawal services are designed around the specific needs of the market, emphasizing a customer-focused strategy. By integrating a diverse range of payment methods, including bank transfers, credit cards, e-wallets, and cryptocurrencies, we aim to provide unmatched financial transaction solutions.

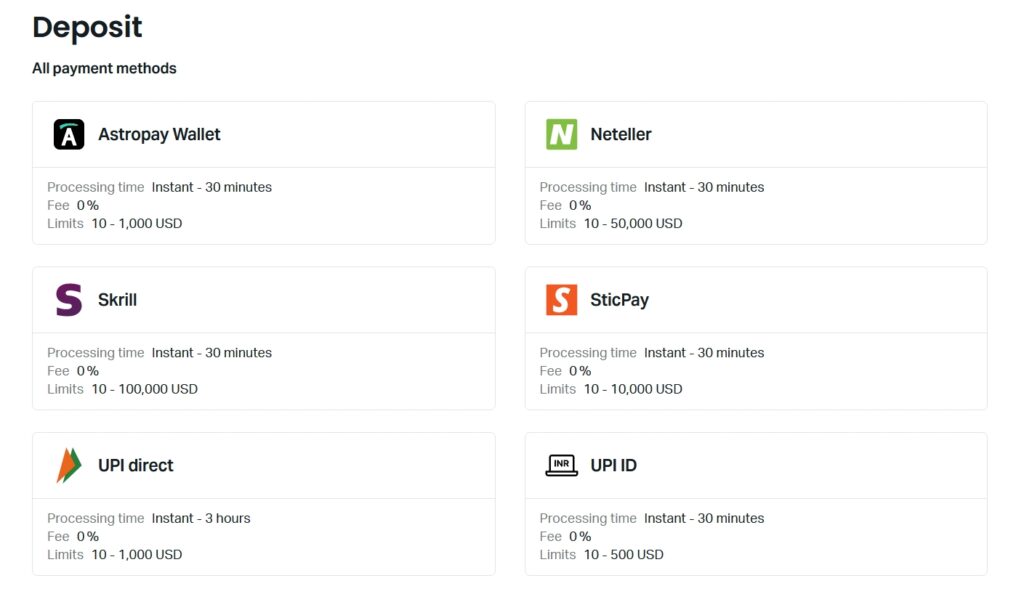

Payment Methods Offered by Exness

Exness offers a comprehensive range of payment methods to accommodate the diverse preferences and needs of its clients around the world. These payment options are designed to provide convenience, speed, and security for both deposits and withdrawals. Here’s an overview of the primary payment methods available through Exness:

Bank Wire Transfers: A traditional and widely used method for transferring funds. Bank wire transfers are reliable and suitable for larger transactions, although they might take several business days to process.

Credit and Debit Cards: Exness supports major credit and debit cards, including Visa and MasterCard. This method is popular for its immediacy, allowing for quick deposits and relatively fast withdrawals compared to bank transfers.

E-Wallets: For those seeking faster and more flexible transactions, Exness offers a variety of e-wallet options. These include but are not limited to Skrill, Neteller, and WebMoney. E-wallets are known for their quick processing times for both deposits and withdrawals.

Local Payment Methods: Understanding the need for localized services, Exness also offers a range of region-specific payment methods. These can include local bank transfers, mobile payments, and other methods preferred in particular countries or regions, facilitating easier access for traders worldwide.

How to Make Exness Deposits and Withdrawals

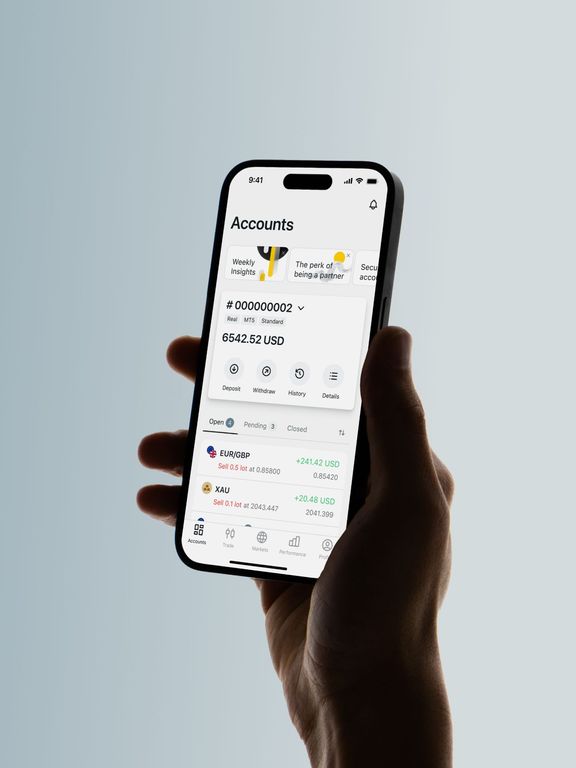

Making deposits and withdrawals with Exness is designed to be straightforward and user-friendly, ensuring traders can efficiently manage their funds. Here’s a step-by-step guide on how to conduct these transactions:

Making Deposits at Exness

- Access Your Personal Area: Log in to your Exness Personal Area on the website or mobile app.

- Choose ‘Deposit’: Navigate to the ‘Deposit’ section.

- Select Payment Method: Pick your preferred payment method from the options available, which may include bank transfers, credit/debit cards, e-wallets, cryptocurrencies, and local payment options.

- Enter Details: Input the amount you wish to deposit and any other required information specific to your chosen payment method.

- Confirm and Complete: Review the transaction details, confirm, and if necessary, complete any additional steps required by your payment provider, such as authentication or redirection to the provider’s payment page.

Making Withdrawals at Exness

- Log In to Personal Area: Start by logging into your Exness Personal Area.

- Navigate to ‘Withdrawal’: Find and click on the ‘Withdrawal’ option.

- Choose Your Withdrawal Method: Select the method you’d like to use for withdrawal. Ideally, use the same method as your deposit to streamline the process.

- Specify Withdrawal Amount: Enter the amount you want to withdraw, adhering to any minimum or maximum limits.

- Verify Transaction Details: Double-check the transaction details, including the withdrawal destination and amount.

- Complete the Withdrawal: Confirm the withdrawal and follow through with any additional verification or steps required by the payment method.

Note on Processing Times and Fees

- Deposits: Most deposit methods are instant, but some, like bank wire transfers, may take several business days.

- Withdrawals: Withdrawal processing times vary; e-wallets and cryptocurrencies tend to be the fastest, while bank transfers may take longer.

- Fees: Exness does not charge deposit or withdrawal fees, but payment processors might. Check the terms of your chosen method.

How Safe to Make Payments Through Exness

Making payments through Exness is considered to be very safe, thanks to a comprehensive array of security measures and protocols that the platform has in place. Here’s an overview of why it’s secure to make payments through Exness:

Advanced Encryption Technologies

Exness uses state-of-the-art encryption technologies to protect data transmission between clients and servers. SSL (Secure Socket Layer) encryption ensures that sensitive information, such as credit card numbers and personal identification details, are securely encrypted during transmission. This makes it extremely difficult for unauthorized parties to intercept or access your financial information.

Two-Factor Authentication (2FA)

To enhance account security, Exness supports two-factor authentication (2FA). This requires users not only to provide their password but also to verify their identity through a second factor, usually a code sent to their mobile device. This dual verification process significantly reduces the risk of unauthorized access to your account.

Compliance with International Standards

Exness adheres to strict international financial regulations, including anti-money laundering (AML) and know your customer (KYC) policies. This compliance ensures that all transactions are monitored and vetted to prevent fraudulent activities, providing an additional layer of security for your payments.

Regular Security Audits

Exness undergoes regular security audits conducted by independent and reputable cybersecurity firms. These audits are designed to identify and rectify potential vulnerabilities within the payment system, ensuring that all security measures are up to date and effective.

Segregation of Funds

Client funds are kept in segregated accounts with top-tier banks, separate from the company’s operational funds. This means that your money is available for withdrawal at any time and cannot be used by Exness for any other purpose, adding an extra layer of protection for your funds.

Monitoring and Fraud Detection Systems

Sophisticated monitoring and fraud detection systems are in place to detect and prevent suspicious activity. Real-time monitoring of transactions helps identify any unusual patterns that could indicate fraudulent behavior, protecting your account from unauthorized transactions.

Continuous Training and Awareness

Exness invests in continuous training for its staff on the latest security practices and threats. This ensures that the team is always equipped to respond effectively to security challenges, further safeguarding your transactions.

Troubleshooting Common Exness Payment Issues

Encountering payment issues can be frustrating, especially in the fast-paced world of online trading. Exness is committed to providing a smooth payment process, but like any platform, issues can occasionally arise. Here are some common payment problems faced by Exness users and tips on how to troubleshoot them:

1. Failed Deposits

- Cause: Failed deposits can occur due to insufficient funds, incorrect payment details, or bank restrictions.

- Solution: Verify your payment details, ensure you have sufficient funds, and check if your bank has restrictions on international or online payments. If the issue persists, try an alternative payment method.

2. Delayed Withdrawals

- Cause: Withdrawal delays often result from incomplete verification processes, exceeding withdrawal limits, or bank processing times.

- Solution: Complete any pending KYC (Know Your Customer) verification processes and ensure you are within the withdrawal limits. If the delay is bank-related, contact your bank to inquire about processing times for international transactions.

3. Withdrawal Rejections

- Cause: Withdrawals can be rejected due to incorrect account details, failure to meet withdrawal criteria, or attempting to withdraw bonus funds.

- Solution: Double-check the account details you’ve provided for accuracy. Ensure that you meet all withdrawal criteria, such as trading volume requirements for bonus withdrawals.

4. Currency Conversion Issues

- Cause: Problems with currency conversion can arise if your bank or payment service provider does not support the currency you wish to deposit or withdraw.

- Solution: Choose a payment method that supports multi-currency transactions or consider using an e-wallet that allows for easier currency conversions.

5. E-Wallet Payment Failures

- Cause: E-wallet payments can fail if your e-wallet account is not verified or if there are restrictions on transactions.

- Solution: Verify your e-wallet account and ensure it is fully functional for receiving or sending payments. Check for any transaction limits that might be affecting your payments.

6. Technical Glitches or Downtimes

- Cause: Occasional technical glitches or system downtimes can affect payment processing.

- Solution: Wait for a short period and try the transaction again. If the problem persists, contact Exness support for assistance and information on any ongoing technical issues.

General Tips for Troubleshooting:

- Contact Support: Exness provides customer support services to address any issues or questions you may have. Don’t hesitate to reach out to them for help.

- Use Alternative Payment Methods: If you’re consistently facing issues with a particular payment method, consider using an alternative option provided by Exness.

- Keep Records: Maintain records of your transactions, including transaction IDs, dates, and screenshots of error messages, as this information can be helpful when seeking support.

Conclusion

Concluding on Exness Payments, it’s clear that Exness has dedicated significant effort to create a comprehensive and user-friendly payment system that caters to the diverse needs of its global clientele. By integrating a wide array of payment methods, including bank transfers, credit/debit cards, e-wallets, cryptocurrencies, and localized payment solutions, Exness ensures that traders can manage their funds with ease and efficiency. This flexibility underscores Exness’s commitment to providing accessible and seamless financial transactions for its users, enhancing their trading experience.

The emphasis on security, through measures like advanced encryption, two-factor authentication, and compliance with international financial regulations, reflects Exness’s dedication to safeguarding client funds and personal information. This robust security framework fosters trust among traders, allowing them to focus on their trading activities without concerns over the safety of their transactions.

FAQ for Exness Payments

What payment methods are available on Exness?

Exness offers a wide range of payment methods including bank wire transfers, credit and debit cards (Visa, MasterCard), e-wallets (Skrill, Neteller, WebMoney), cryptocurrencies (Bitcoin), and local payment methods specific to certain regions.

Are there any fees for depositing or withdrawing funds from Exness?

Exness does not charge any fees for deposits or withdrawals. However, payment processors or your bank may impose their own fees. It’s recommended to check with them for any potential charges.

How long do deposits and withdrawals take to process on Exness?

Most deposits are processed instantly, but the processing time for withdrawals varies depending on the payment method. E-wallets and cryptocurrencies usually offer the fastest withdrawal times, while bank transfers may take longer.

Is it safe to make payments through Exness?

Yes, Exness employs advanced security measures including SSL encryption, two-factor authentication (2FA), and compliance with international financial standards to protect your transactions and personal information.

Can I withdraw my funds to a different payment method than the one I used to deposit?

For security reasons and to comply with anti-money laundering regulations, Exness recommends withdrawing funds to the same payment method used for deposit. If that’s not possible, alternative arrangements may be made by contacting customer support.

What is the minimum deposit or withdrawal amount on Exness?

The minimum deposit and withdrawal amounts vary by payment method. Exness aims to keep these limits as low as possible to accommodate all traders. For specific amounts, refer to the Exness Payments section on their website.