Exness Account Types

Exness account types are designed to cater to the diverse needs and preferences of traders by offering different trading conditions, including spreads, commissions, leverage options, and minimum deposit requirements. Exness offers a diverse range of account types tailored to meet the varying needs and preferences of traders worldwide. From novices to experienced professionals, Exness caters to all by providing a spectrum of account options including the Standard, Professional, and Zero accounts among others.

Exness excels in transparency and customer support. They provide detailed information on each account type, empowering traders to make informed decisions aligned with their trading style and risk tolerance. Backed by 24/7 customer support, traders can promptly get assistance and answers to their queries. Whether it’s the straightforward Standard Account for beginners, the advanced Professional Account for seasoned traders, or the Zero Account with near-zero spreads for high-volume trading, Exness ensures optimal trading conditions for all. This holistic approach to meeting diverse client needs has established Exness as a trusted and flexible broker in the competitive online trading landscape.

Types of Exness Account

Exness offers a range of account types. Each account type comes with its unique set of features, allowing traders to choose the one that best suits their trading strategy, experience level, and financial goals. Here’s an overview of the main types of accounts provided by Exness:

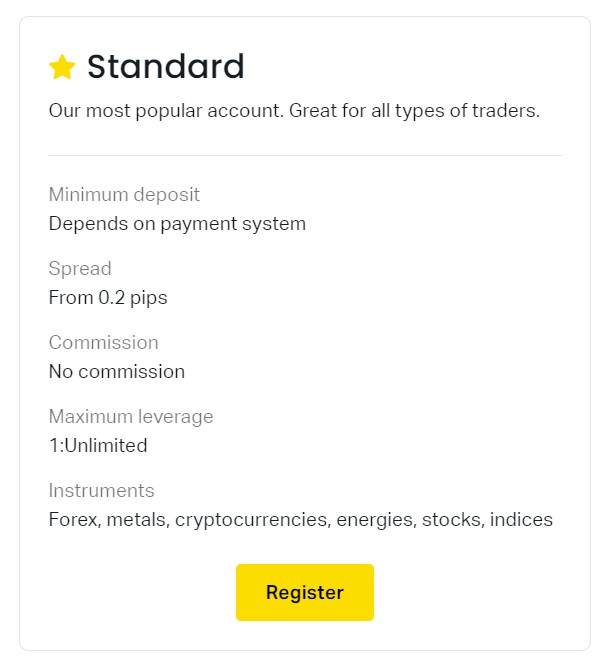

Standard Accounts:

- Standard: Ideal for beginners, the Standard account requires no minimum deposit, offers competitive spreads, and provides access to a wide range of financial instruments. It’s characterized by its simplicity and is suited for those new to trading.

- Standard Cent: Designed for novices, the Standard Cent account allows traders to trade with smaller lot sizes and lower risk. It’s perfect for those looking to gain trading experience without significant investment.

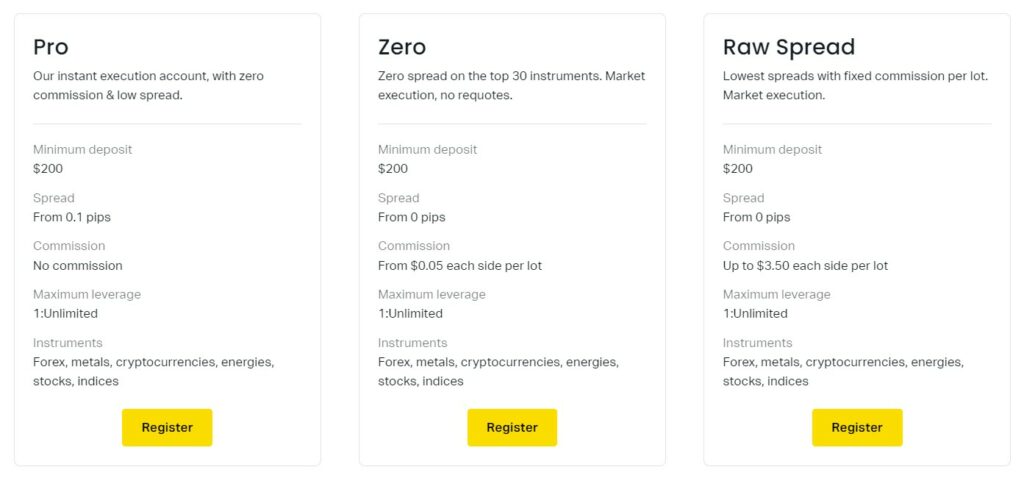

Professional Accounts:

- Raw Spread: This account offers ultra-low spreads starting from 0.0 pips with a commission on trades. It’s suitable for scalpers and high-volume traders who prefer trading with the tightest spreads.

- Zero: With zero spread for several major currency pairs and a commission on trades, the Zero account is tailored for traders looking to maximize their strategies on pairs with traditionally lower spreads.

- Pro: The Pro account provides a balance between low spreads and no commissions. It’s designed for experienced traders who require more favorable trading conditions without additional commission costs.

Demo Account:

- Exness also offers a Demo account, which is a risk-free option for traders wanting to practice their strategies or get familiar with the trading platform without investing real money.

Islamic Account:

- For traders who require an account that complies with Sharia law, Exness provides an Islamic Account option that can be applied to both Standard and Professional accounts, offering a swap-free trading experience.

ECN Account:

- Exness may also offer ECN (Electronic Communication Network) accounts, which provide direct access to interbank liquidity and often feature variable spreads and commissions.

Exness Standard Accounts

Exness Standard Accounts are tailored to cater to a wide range of traders, from beginners to those with more experience seeking straightforward and accessible trading conditions. These accounts feature competitive spreads starting from 0.3 pips, no commissions on trades, and no minimum deposit requirement, making them an attractive option for traders looking to minimize costs and maximize accessibility. With leverage up to 1:2000, traders have the flexibility to manage their risk and trading strategy effectively. The Standard and Standard Cent Accounts differ primarily in their trading volume, with the latter designed for those wishing to trade with smaller lot sizes and lower financial risk, making it ideal for new traders or those testing new strategies.

| Feature | Standard Account | Standard Cent Account |

| Target Users | Novices to experienced traders | Novice traders or those testing strategies |

| Spreads | From 0.3 pips | From 0.3 pips |

| Commission | No commission | No commission |

| Minimum Deposit | No minimum deposit | No minimum deposit |

| Leverage | Up to 1:2000 | Up to 1:2000 |

| Trading Lot Size | Standard lots | Cent lots |

| Suitable For | Traders preferring straightforward trading without commissions | Beginners or cautious traders with minimal risk |

Exness Professional Accounts

Exness Professional Accounts, including the Raw Spread, Zero, and Pro accounts, are designed for experienced traders seeking advanced trading conditions. These accounts offer the benefit of tighter spreads starting from 0.0 pips for Raw Spread accounts, with commissions applicable on trades to ensure the lowest possible spread. Zero accounts, on the other hand, provide zero spreads on major currency pairs, appealing to high-volume traders looking for the best prices on key pairs, albeit with a commission on trades.

| Feature | Raw Spread Account | Zero Account | Pro Account |

| Target Users | Traders prioritizing tight spreads, willing to pay commission | Traders seeking zero spreads on major pairs, comfortable with commission | Experienced traders preferring low spreads without commissions |

| Spreads | Starts from 0.0 pips | Zero on major currency pairs | Low but variable, from 0.1 pips |

| Commission | Yes | Yes | No |

| Minimum Deposit | Higher than standard accounts | Higher than standard accounts | Higher than standard accounts |

| Leverage | Up to 1:2000 | Up to 1:2000 | Up to 1:2000 |

| Trading Instruments | Wide range | Broad selection | Wide array |

| Suitable For | Scalpers and automated system users | High-volume traders | Traders preferring manual trading strategies |

Exness Demo Account

The Exness Demo Account offers a risk-free platform for traders to hone their trading skills, test strategies, and familiarize themselves with the Exness trading environment without any financial risk. Functioning with virtual funds, the Demo Account perfectly simulates real market conditions, including live prices and market movements. It’s an invaluable educational tool, allowing both novice and experienced traders to practice and refine their trading techniques. Accessible across both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, the Demo Account ensures users can explore a wide range of functionalities and tools offered by these platforms.

| Feature | Details |

| Purpose | Practice trading strategies, familiarize with trading environment |

| Risk Level | No real money risk, fully simulated |

| Market Conditions | Simulates real market conditions with live prices and movements |

| Platform Access | Access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms |

| Usage Limit | Typically unlimited, can be reset with virtual funds as needed |

| Financial Commitment | No deposit required, comes with virtual funds |

| Educational Value | Excellent for learning market dynamics, chart analysis, and the effects of economic events |

| Ideal Users | Beginner traders, experienced traders testing new strategies, traders exploring new markets |

Exness Islamic Account

The Exness Islamic Account caters specifically to Muslim traders, adhering to the principles of Islamic finance by offering a swap-free trading environment that complies with Sharia law. This type of account eliminates the concept of Riba (interest) on overnight positions, a crucial aspect for traders seeking to align their trading activities with their religious beliefs. Islamic Accounts at Exness maintain the same competitive trading conditions as standard accounts, including access to all trading instruments and platforms without imposing additional fees or charges in lieu of swaps.

| Feature | Details |

| Swap-Free | Yes, no swaps or overnight interest |

| Hidden Fees | No hidden charges or fees in place of swaps |

| Trading Instruments | Access to all trading instruments without restrictions |

| Trading Conditions | Same as conventional accounts (spreads, leverage, etc.) |

| Conversion Process | Straightforward, usually involves contacting customer support |

| Account Verification | May require additional verification for conversion |

| Account Restrictions | Might be restrictions on certain account types; check with broker |

| Trading Strategies Compliance | Should align with Islamic principles, avoiding speculative practices |

Exness ECN Account

An ECN (Electronic Communication Network) account is a type of trading account used primarily in the foreign exchange (forex) market. It’s designed to provide direct access to liquidity providers, such as banks, financial institutions, and other traders, without the need for a traditional intermediary like a broker.

ECN accounts are popular among professional traders, algorithmic traders, and those who require fast execution speeds and access to deep liquidity. However, they may not be suitable for all traders, especially beginners, as they often require a higher minimum deposit and may involve a steeper learning curve.

Choosing the Right Exness Account Type

Choosing the right Exness account type is a crucial decision that can significantly impact your trading experience and success. Each account type offered by Exness caters to different trading styles, experience levels, and financial goals. Here are some considerations to help you select the account that best suits your trading needs:

1. Understand Your Trading Style

- Scalping and High-Volume Trading: If you prefer scalping or high-volume trading strategies, consider the Raw Spread or Zero accounts. These accounts offer low spreads and are designed for traders who benefit from trading with minimal bid-ask spreads.

- Beginners and Low-Risk Traders: If you’re new to trading or prefer to trade with lower risks, the Standard or Standard Cent accounts may be more suitable. These accounts allow you to trade with smaller lot sizes and require no minimum deposit, making it easier to start and manage risk.

2. Consider the Financial Commitment

- Minimum Deposit: While the Standard accounts typically do not require a minimum deposit, professional account types might necessitate a larger financial commitment. Assess your budget and financial goals to choose an account that aligns with your investment capacity.

- Spreads vs. Commissions: Standard accounts usually offer no commission trades with slightly higher spreads, ideal for those who prefer a straightforward cost structure. In contrast, professional accounts like Raw Spread and Zero may offer lower spreads but include a commission on trades. Determine which cost structure aligns best with your trading activity and preferences.

3. Evaluate the Leverage Options

- Leverage can significantly amplify your trading capacity and profits but also increases risk. Examine the leverage options available for each account type. Beginners may prefer to start with lower leverage to minimize risk, while more experienced traders might seek higher leverage for greater trading flexibility.

4. Account Features and Tools

- Consider the specific features, tools, and financial instruments available for each account type. Ensure that the account you choose provides access to the markets and trading tools that are essential for your trading strategy.

5. Trial with a Demo Account

- Before committing to a specific account type, it’s advisable to experiment with a Demo Account. This allows you to get a feel for the trading platform and test your strategies without any financial risk.

6. Swap-Free Option for Islamic Traders

- If you require an account that complies with Sharia law, ensure that the account type you choose offers a swap-free option. This is available for both Standard and Professional accounts but may need to be requested or activated.

Selecting the right Exness account type involves a careful consideration of your trading style, financial capacity, preferred cost structure, and the specific features each account offers. Take advantage of Exness’s diverse account options and the availability of a demo account to make an informed decision that aligns with your trading goals and strategies.

Comparison of Exness Account Types

Comparing the different account types offered by Exness can help traders understand which option might best suit their needs. Here’s a detailed comparison based on key features such as spreads, commission, minimum deposit, leverage, and suitable trader profile:

Standard Accounts

- Standard

- Spreads: From 0.3 pips

- Commission: No commission

- Minimum Deposit: No minimum deposit required

- Leverage: Up to 1:2000

- Suitable for: Beginners and casual traders who prefer simplicity and low entry barriers.

- Standard Cent

- Spreads: From 0.3 pips

- Commission: No commission

- Minimum Deposit: No minimum deposit required

- Leverage: Up to 1:2000 but trades are in cent lots

- Suitable for: Novice traders practicing strategies or those with limited capital, aiming to trade with lower risk.

Professional Accounts

- Zero

- Spreads: 0 pips on select pairs

- Commission: Yes, commission charged

- Minimum Deposit: Higher than standard accounts

- Leverage: Up to 1:2000

- Suitable for: Traders looking for zero spreads on major pairs and are comfortable with commission fees, suitable for high-volume trading.

- Pro

- Spreads: From 0.1 pips

- Commission: No commission

- Minimum Deposit: Higher than standard accounts

- Leverage: Up to 1:2000

- Suitable for: Experienced traders who need better spreads without the commission costs and have significant trading capital.

- Raw Spread

- Spreads: From 0.0 pips

- Commission: Yes, commission charged

- Minimum Deposit: Higher than standard accounts

- Leverage: Up to 1:2000

- Suitable for: High-volume traders and scalpers who prefer tight spreads and are okay with paying commissions.

Other Considerations

- Demo Account: All potential traders should start with a Demo account to familiarize themselves with Exness platforms and test trading strategies without any risk.

- Islamic Account: Swap-free options available for traders who require accounts that comply with Sharia law. This option can be applied to both Standard and Professional accounts but may require contacting support to activate.

Conclusion

Exness offers a diverse array of account types to cater to the varied needs and preferences of traders from all backgrounds and levels of experience. From the Standard and Standard Cent accounts designed for beginners and those preferring minimal financial commitment, to the Raw Spread, Zero, and Pro accounts tailored for professional traders seeking optimal trading conditions, Exness demonstrates a commitment to providing flexible trading solutions. The key to selecting the right account lies in understanding your own trading style, risk tolerance, and financial goals, as well as considering the specifics of each account type, including spreads, commissions, leverage, and minimum deposit requirements.

Exness’s approach to offering different account types underscores the importance of accessibility and customization in the trading experience. Whether you are a novice trader taking your first steps in the financial markets or an experienced professional looking for competitive spreads and high leverage, there is an Exness account that fits your needs. Additionally, the option to switch between account types or to test strategies in a risk-free demo environment provides valuable flexibility and learning opportunities.

FAQ for Exness Account Types

Is leverage the same across all Exness account types?

Leverage options may vary between different account types at Exness. While high leverage options are available across many account types, the specific leverage offered might depend on the account type, regulatory requirements, and the trader’s country of residence. Always check the current leverage settings available for your selected account type.

What are the benefits of using a Demo Account at Exness?

A Demo Account at Exness provides a risk-free environment for traders to practice their trading strategies, familiarize themselves with the trading platform, and learn about market dynamics without risking real money. It’s an invaluable tool for beginners for learning and for experienced traders to test new strategies.

What are the key advantages of an Exness Professional Account?

Professional Accounts at Exness offer several advantages, including tighter spreads starting from 0.0 pips, higher leverage options, and access to a broader range of financial instruments. These accounts are designed for experienced traders and come in different types (Raw Spread, Zero, and Pro), each tailored to specific trading needs and preferences, such as the desire for lower spreads or commission-free trading.

What should I consider before choosing an account type at Exness?

When selecting an account type at Exness, consider your trading style, experience level, financial goals, and the specific features of each account type, such as spreads, commissions, minimum deposit requirements, and available leverage. Beginners might prefer Standard Accounts for their simplicity and lower risk, while experienced traders may opt for Professional Accounts that offer more competitive trading conditions.

What is the minimum deposit required for a Professional Account at Exness?

The minimum deposit requirement for Professional Accounts at Exness varies depending on the specific account type. Generally, Professional Accounts require a higher minimum deposit than Standard Accounts. Exact details can be found on the Exness website or by contacting their customer support.

Can I have multiple account types with Exness?

Yes, traders can have multiple account types with Exness. This allows traders to manage different trading strategies across various account types simultaneously. However, it’s important to manage these accounts effectively to ensure that trading activities align with your overall trading goals and risk management strategies.